Rebate invoices are created monthly for each manufacturer that has one or more rebate contracts setup. These monthly invoices are then sent to the manufacturer, so the state can receive the money from the rebate. It takes a five days before redemptions from the previous month are all processed. Rebate invoices are typically created the 10th of the month for the preceding month.

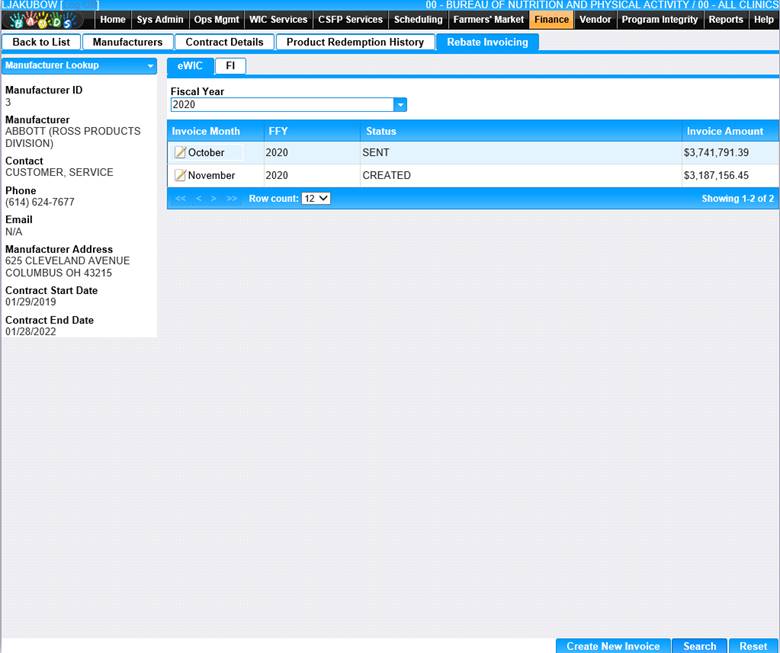

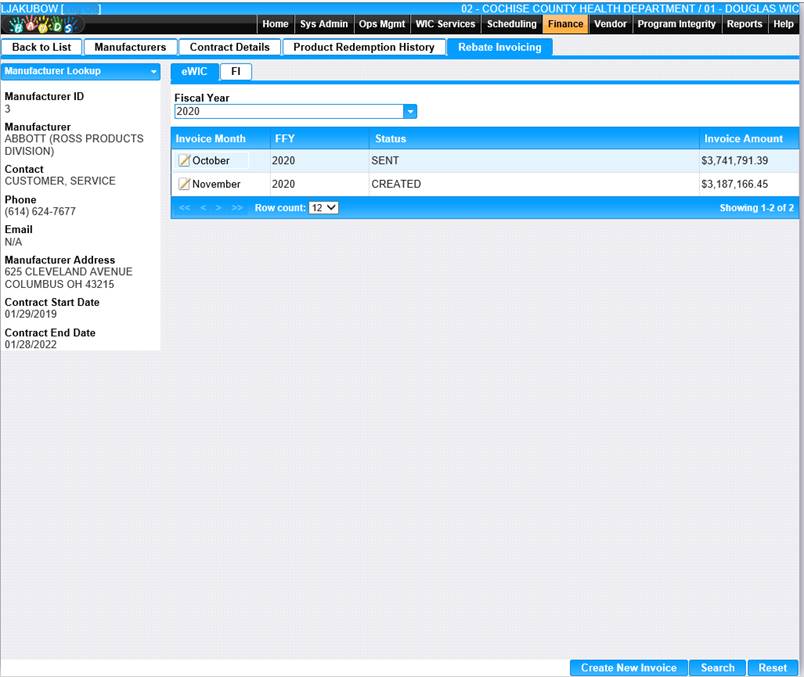

From the existing manufacturer select the Rebate Invoicing tab. HANDS defaults to the eWIC Rebate Invoicing tab, System defaults to current Fiscal Year.

1. Click Create New Invoice, to create a new invoice for the manufacturer.

2. Click Search, displays the data for the Fiscal Year selected.

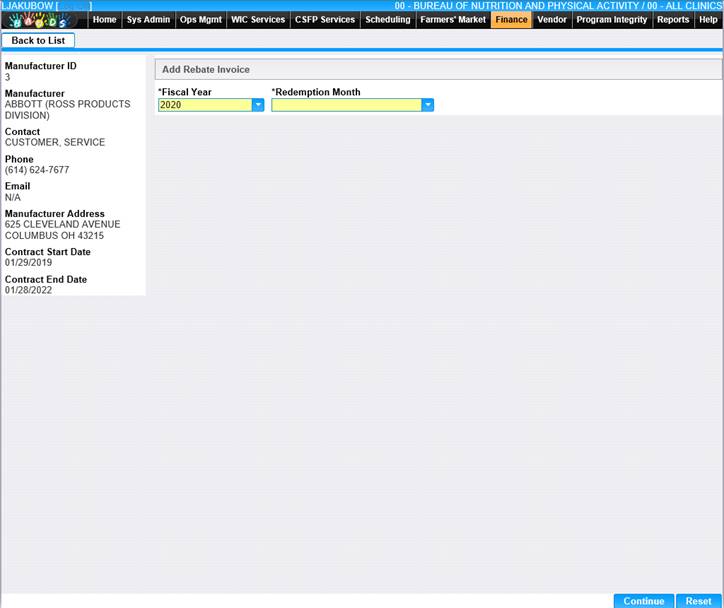

To Create a New Rebate Invoice

1. Click the Create New Invoice button at the bottom of the page, to Create a New Invoice.

The redemption month is the month that the invoice is being created for.

2. Enter all required fields to complete the Add Rebate Invoice page.

3. To discard unsaved changes, click the Reset button at the bottom of the page.

4. To keep changes, click the Continue button at the bottom of the page.

The system will automatically determine the dollar amount to be invoiced to the manufacturer. This is done by finding the sum of all redemptions for the selected manufacturer and the price per unit on the rebate contracts for that manufacturer. The system will automatically take the number of units redeemed for each rebatable food during the invoice month and multiply it by the price per unit on that foods rebate contract. The sum of these amounts combined is what determines the total rebate invoice amount for the month for the manufacturer. Once this is completed the rebate invoice has a status of created. The monitoring rebate collections page, discussed below, displays the status of rebate invoices.

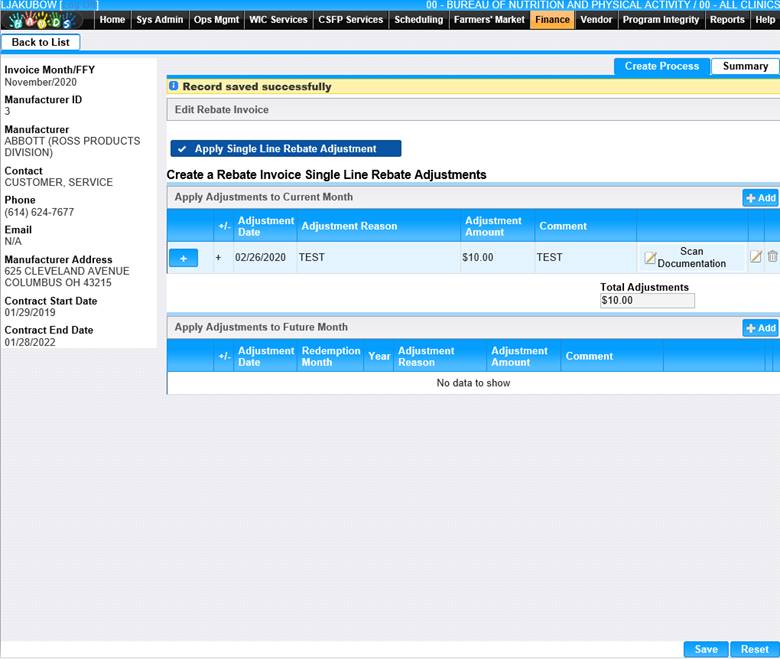

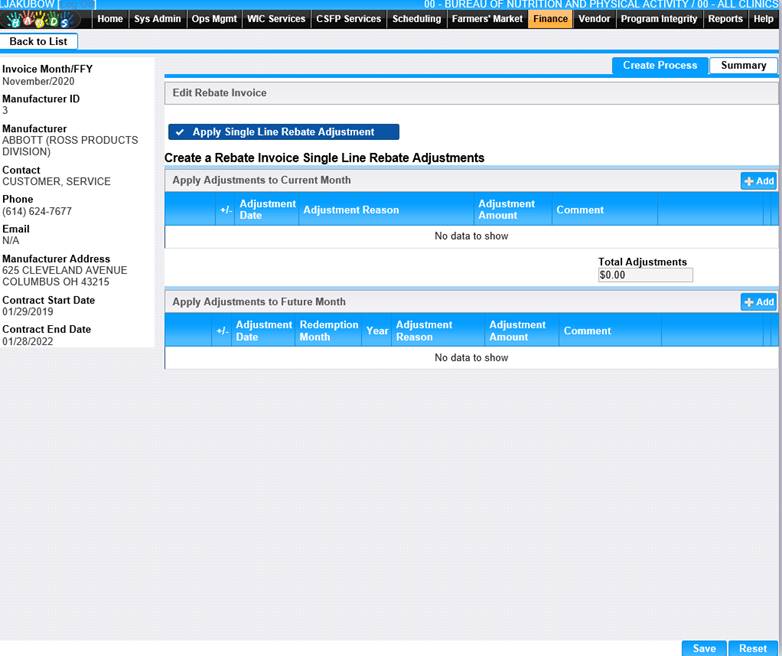

Create Rebate Adjustment

After the rebate invoice is created the user can apply both current and future month rebate adjustments. A rebate adjustment may have a positive or negative effect on the rebate invoice. A current month rebate adjustment will affect rebate invoice that the user is currently within, while a future month rebate adjustment the user can select a month in the future that the adjustment will affect. Single line rebate adjustments are to adjust for differences between the raw data the manufacturer gets and the data within the system. These differences could be due to sync failures, creating the rebate invoice too early for the month and missing some redemption data or a variety of other issues.

From the existing manufacturer select the Rebate Invoicing tab. HANDS defaults to the eWIC Rebate Invoicing tab, System defaults to current Fiscal Year.

1. Select the applicable Fiscal Year.

2. Click Search, displays the data for the Fiscal Year selected.

3. Click the Edit icon for the invoice month adjustment needed to be made for.

1. To add an Adjustment, click the applicable Add button in the Apply Adjustment to specific month section.

2. To discard unsaved changes, click the Reset button at the bottom of the page.

3. To keep changes, click the Save button at the bottom of the page.

Edit Adjustments for Rebate Invoice

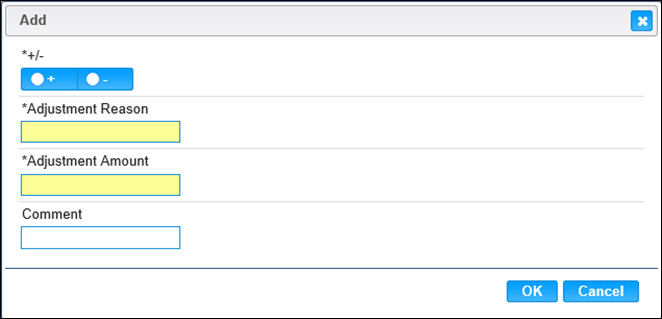

1. Click the Add button in the top right corner of the applicable Apply Adjustment section to add an adjustment.

2. Enter all required fields to complete the Add page.

3. To discard unsaved changes, click cancel at the bottom of the window.

4. To keep changes, click the OK button at the bottom of the window.